Form 1096 Printable

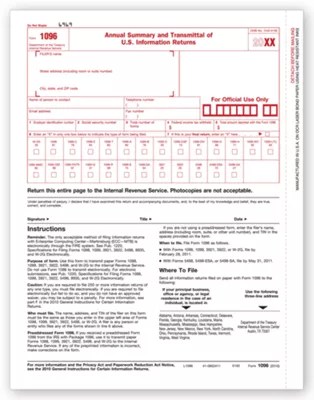

Form 1096 Printable - What is irs form 1096? Tax form 1096 explained in less than 5 minutes. Irs form 1096, annual summary and transmittal of u.s. Irs form 1096 often goes unnoticed amidst the plethora of tax documents, but it plays a critical role in tax reporting. How to use the 1096. Updated on february 23, 2022. Small business resource center small business tax prep. The purpose of form 1096 is to provide a concise summary of the 1099 forms that are included with the 1096 form. If you run a small business and paid an independent contractor to do work for you this year, odds are you need to submit form 1096 to the irs. May 27, 2023 by ryan casarez.

1096 Transmittal Form (L1096)

Tax form 1096 explained in less than 5 minutes. May 27, 2023 by ryan casarez. Updated on february 23, 2022. In order to correctly file irs form 1096, you’ll complete the form for each of your information returns (remembering that you must use an official version of form. If you run a small business and paid an independent contractor to.

Printable 1096 Form 2021 Customize and Print

Irs form 1096 often goes unnoticed amidst the plethora of tax documents, but it plays a critical role in tax reporting. Tax form 1096 explained in less than 5 minutes. Information returns, is used as a summary or “cover sheet” to various types of other forms. Updated on february 23, 2022. May 27, 2023 by ryan casarez.

Printable Form 1096 Form 1096 (officially the annual summary and transmittal of u.s.

Small business resource center small business tax prep. Tax form 1096 explained in less than 5 minutes. May 27, 2023 by ryan casarez. If you run a small business and paid an independent contractor to do work for you this year, odds are you need to submit form 1096 to the irs. What is irs form 1096?

1096 Annual Summary Transmittal Forms & Fulfillment

May 27, 2023 by ryan casarez. Irs form 1096 often goes unnoticed amidst the plethora of tax documents, but it plays a critical role in tax reporting. In order to correctly file irs form 1096, you’ll complete the form for each of your information returns (remembering that you must use an official version of form. Information returns, is used as.

Form 1096 Printable Fill Out and Sign Printable PDF Template signNow

May 27, 2023 by ryan casarez. What is irs form 1096? How to use the 1096. Irs form 1096 often goes unnoticed amidst the plethora of tax documents, but it plays a critical role in tax reporting. Information returns, is used as a summary or “cover sheet” to various types of other forms.

IRS REGULATED 1096 FORMS PACKAGE OF 25 FORMS Amazon.ca Office Products

How to use the 1096. Updated on february 23, 2022. Information returns, is used as a summary or “cover sheet” to various types of other forms. In order to correctly file irs form 1096, you’ll complete the form for each of your information returns (remembering that you must use an official version of form. Irs form 1096 often goes unnoticed.

1096 Tax Form for Dot Matrix Printers, Fiscal Year 2022, TwoPart Carbonless, 8 x 11, 10 Forms

Small business resource center small business tax prep. If you run a small business and paid an independent contractor to do work for you this year, odds are you need to submit form 1096 to the irs. Irs form 1096 often goes unnoticed amidst the plethora of tax documents, but it plays a critical role in tax reporting. How to.

IRS 1096 Form Download Create Edit Fill And Print Printable Form 2021

The purpose of form 1096 is to provide a concise summary of the 1099 forms that are included with the 1096 form. In order to correctly file irs form 1096, you’ll complete the form for each of your information returns (remembering that you must use an official version of form. Updated on february 23, 2022. If you run a small.

Printable 1096 Form 2021 Customize and Print

If you run a small business and paid an independent contractor to do work for you this year, odds are you need to submit form 1096 to the irs. How to use the 1096. Small business resource center small business tax prep. In order to correctly file irs form 1096, you’ll complete the form for each of your information returns.

Form 1096 A Simple Guide Bench Accounting

The purpose of form 1096 is to provide a concise summary of the 1099 forms that are included with the 1096 form. Updated on february 23, 2022. Information returns, is used as a summary or “cover sheet” to various types of other forms. In order to correctly file irs form 1096, you’ll complete the form for each of your information.

Irs form 1096, annual summary and transmittal of u.s. The purpose of form 1096 is to provide a concise summary of the 1099 forms that are included with the 1096 form. Tax form 1096 explained in less than 5 minutes. Updated on february 23, 2022. May 27, 2023 by ryan casarez. What is irs form 1096? Irs form 1096 often goes unnoticed amidst the plethora of tax documents, but it plays a critical role in tax reporting. In order to correctly file irs form 1096, you’ll complete the form for each of your information returns (remembering that you must use an official version of form. How to use the 1096. Information returns, is used as a summary or “cover sheet” to various types of other forms. If you run a small business and paid an independent contractor to do work for you this year, odds are you need to submit form 1096 to the irs. Small business resource center small business tax prep.

In Order To Correctly File Irs Form 1096, You’ll Complete The Form For Each Of Your Information Returns (Remembering That You Must Use An Official Version Of Form.

If you run a small business and paid an independent contractor to do work for you this year, odds are you need to submit form 1096 to the irs. May 27, 2023 by ryan casarez. How to use the 1096. Irs form 1096, annual summary and transmittal of u.s.

Irs Form 1096 Often Goes Unnoticed Amidst The Plethora Of Tax Documents, But It Plays A Critical Role In Tax Reporting.

Small business resource center small business tax prep. Updated on february 23, 2022. Tax form 1096 explained in less than 5 minutes. The purpose of form 1096 is to provide a concise summary of the 1099 forms that are included with the 1096 form.

Information Returns, Is Used As A Summary Or “Cover Sheet” To Various Types Of Other Forms.

What is irs form 1096?